Employees are stressed out more than ever over money (Can you blame them?!) and it negatively impacts your business.

Join us for a breakfast workshop where we will discuss....

Join us in person for a delicious breakfast at the London Club, Tuesday, February 28th, 2023 at 8:30AM

Employees are stressed out more than ever over money (Can you blame them?!) and it negatively impacts your business.

Join us for a breakfast workshop where we will discuss....

How to Improve Your Employee’s Financial Well-Being and Increase Your Bottom Line

Join us in person for a delicious breakfast and interactive workshop at the London Club, Tuesday, February 28th, 2023 from 8:30 – 10:30 AM.

Hi! I’m Danielle! I’m so happy to meet you!

As a Money Coach, I work with people who are tired of living paycheck-to-paycheck and help them reduce stress and anxiety around money by teaching new strategies to help improve money management skills. While I am not an advisor (I do not sell investment or insurance products), I work with those who are ready to change their behaviours and improve their relationship with money.

Some of the content you will discover

during this 2-hour interactive session:

1

How actively addressing the financial wellness of employees will provide a competitive edge and deliver bottom-line results

2

Learn how to help your employees implement money management strategies to spend their paychecks with purpose.

3

Learn simple strategies that can not only benefit your employees but your own personal and business finances.

4

Investment opportunities are great, but if employees are struggling financially, they won’t take advantage of them if their money management strategies need work.

“Workers worrying about their finances on the job will cost employers more than $40 billion in 2022. Even more shocking is that this figure has exploded significantly since 2021 when it was calculated that financial stress in the workplace accounted for $26.9 billion in lost productivity. The accelerated growth is the result of several factors but is rooted in the worsening individual financial situation of working Canadians this year.”

The 14th Annual National Payroll Institute Survey of Working Canadians

Doing nothing means employers can expect more erosion to productivity in the year ahead. As staff shortages persist and a recession looms, weakening productivity is likely the last thing business owners want to spend their time worrying about.

This session is a Must-Attend if….

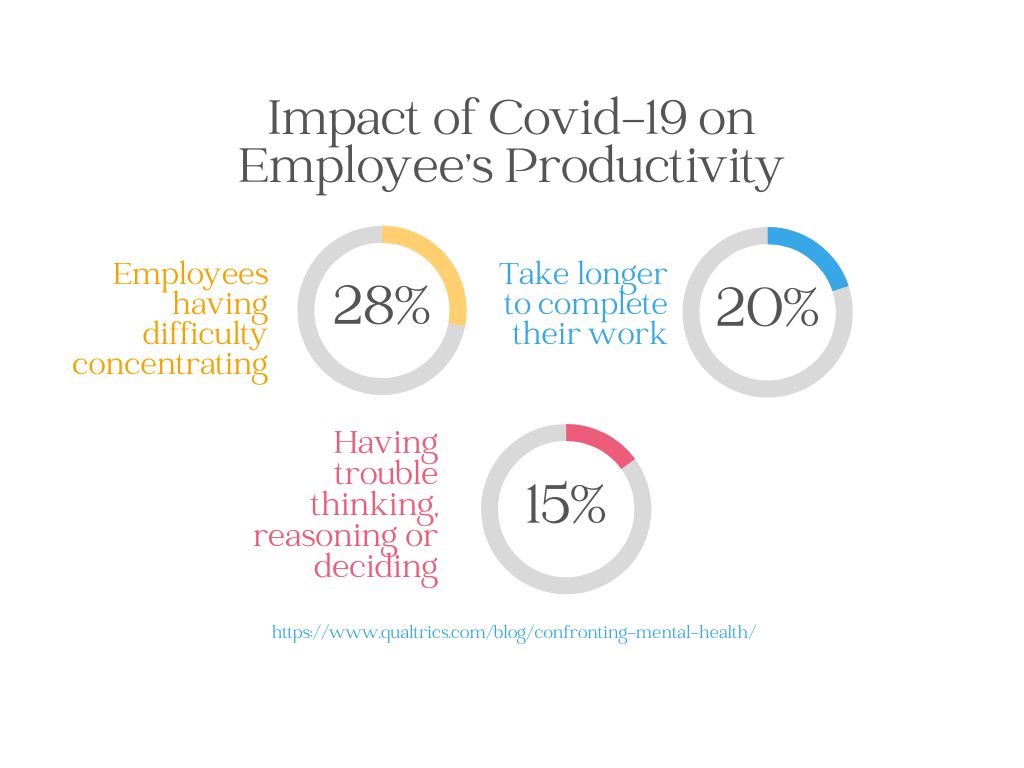

You care about the mental health of your employees

You want to reduce absenteeism and improve productivity

You want your employees to be more engaged and enjoy working for your company (improving retention)

You want to improve your work culture

There are only 20 spots available. Register now to save your seat!

Thanks to Stephen Hebden of Rawling Financial for providing the room and breakfast for this event!

100% of the proceeds will be donated to the Humane Society London Middlesex as they are raising funds for their new facility, and Helping Paws, a volunteer-run non-profit company who are actively rescuing and helping animals in need in London, St. Thomas, and the surrounding area.

You will receive an introduction to the psychology of money and how you can help your employees improve their financial behaviours. In return, you will see improved productivity and engagement, and happier employees that will ultimately improve retention rates as well as an improved bottom line.

Register For the Event!

Not able to attend?

Sign up for future employee training notifications

[mailpoet_form id=”3″]

After this workshop, you will have actionable strategies to implement with your staff to help begin their journey to better money management and reduce stress around their finances.

Can’t make the date? Click here to be notified of future sessions and updates from The Corcoran Coaching Group.

See you there!